“What the government gives it must first take away.” (John S. Coleman)

It certainly seemed like a win for taxpayers when Finance Minister Enoch Godongwana announced in his February Budget Speech that the corporate income tax (CIT) rate has been reduced from 28% to 27% for companies with a tax year ending on or after 31 March 2023.

But as we are reminded by John Coleman’s quote: “What the government gives it must first take away.”

In this particular instance, to give a 1% reduction in the corporate tax rate, government limited the tax relief corporate taxpayers have enjoyed in the past in terms of assessed losses and interest deductions.

According to Treasury, South Africa is following an international trend evident over the past few years to restrict the use of assessed losses and reduce the corporate income tax rate.

What’s the link to the corporate tax rate reduction?

The 1% reduction in the corporate tax rate is expected to cost the fiscus R2.6 billion -in the year of assessment commencing on or after 1 April 2022. To ‘neutralise’ this – and thus achieve a revenue-neutral reduction in the corporate tax rate – two further changes to corporate tax rules have been made.

The first is further limitation of corporate interest deductions, specifically on multinationals; and the second is restrictions on the use of assessed losses to reduce future corporate tax liabilities.

The first involves changes to, amongst others, the scope and thresholds of the interest deduction limitation, achieved by fixing and limiting the interest deduction limitation ratio to 30% of a taxpayer’s “adjusted taxable income”, instead of the earlier flexible percentage (adjusted upwards and downwards based on the average repo rate) capped at 60%.

What are the new assessed losses rules?

Assessed loss rules were originally created to smooth the tax burden for:

- businesses that require a significant upfront capital outlay, causing assessed losses to accumulate before any profit is realised;

- cyclical businesses that realise losses in some years and profits in others, such as farming operations, and

- companies that suffer temporary setbacks and losses before recovering to become profitable again.

As a result companies could previously offset the full balance of any assessed loss carried forward from a previous tax year against all its taxable income for the current year. In addition, companies could carry over any assessed loss balance remaining to future years indefinitely subject only to the requirement that the company continues to carry on a trade. In effect, it meant that a company would only become liable for income tax once it earned a taxable profit and the balance of the assessed loss was exhausted.

Under the new rules, assessed losses brought forward from a previous year of assessment – regardless of the amount – can only be offset against the higher of R1 million or a maximum of 80% of taxable income for the current year.

This means that income tax will now always be levied on 20% of the taxable income for the year where the taxable income in the current year exceeds the R1 million threshold, no matter what the assessed loss balance carried forward from previous years may be. This will have adverse tax cash flow implications for some companies.

Small companies unaffected, and losses are not forfeited, unless…

Smaller companies with a taxable income below R1 million will not be affected by the new rules.

Further good news is that companies will not forfeit the balance of the assessed loss that could not be utilised. The balance can be carried forward to the next tax year, provided that the company earns income from trade in the succeeding year of assessment.

However, beware: if a company does not trade for a full year of assessment and no income is earned from such trade, the assessed loss will be lost.

When do the new rules apply, and which companies are affected?

The new rules apply to any year of assessment that ends on or after 31 March 2023, which, in more practical terms, means years of assessment that begin from 1 April 2022 onwards.

It is also important to note that the new limitation will apply to assessed losses generated prior to the effective date, as well as those arising after 1 April 2022.

Some companies will not be affected immediately, for example, companies with no assessed loss balance, or those with a taxable loss.

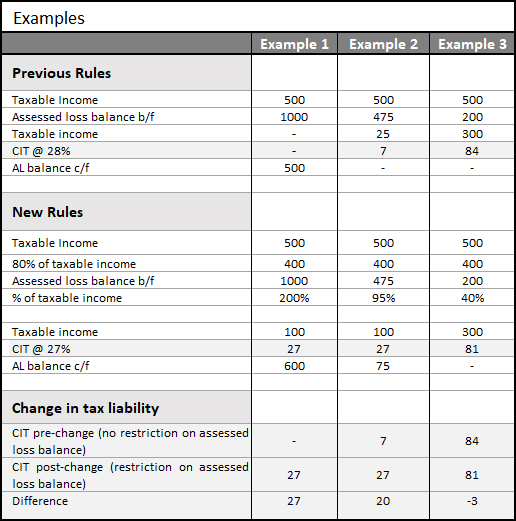

The cash flow implications, with examples

For those companies affected, the changes will have tax cash flow implications, best illustrated by the way of examples –

Table based on an example from Draft Explanatory Memorandum On The Taxation Laws Amendment Bill, 2021

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© CA(SA)DotNews

Recent Comments