Budget 2024 effectively brought an increase in personal income tax by not adjusting the tables for tax rates, rebates and medical tax credits, while also implementing substantial increases in ‘sin’ taxes and introducing a proposed global tax on multinational companies.

This selection of official SARS Tax Tables and other useful resources will help clarify your tax position for the new tax year. Then follow the link to Fin 24’s Budget Calculator (just follow the four-step process) to perform your own calculation.

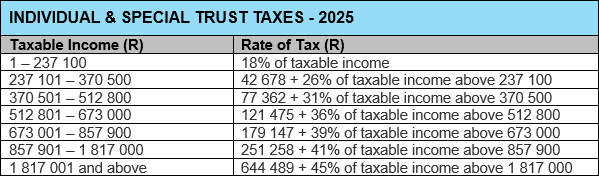

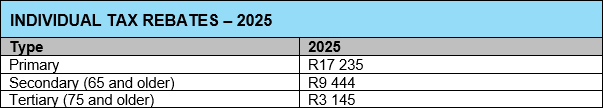

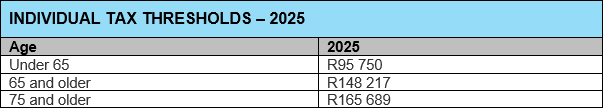

Individual taxpayers – tax tables unchanged

Source: SARS

Source: SARS

Source: SARS

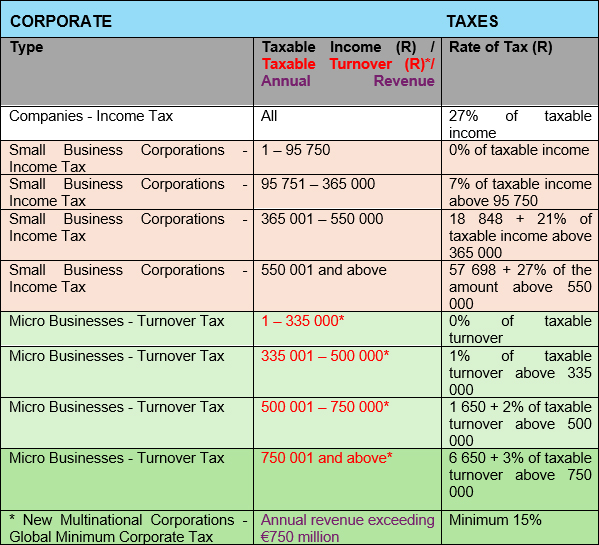

Businesses – Corporate tax rates – extended

Sources: SARS’ Budget Tax Guide 2024; Budget Speech 2024

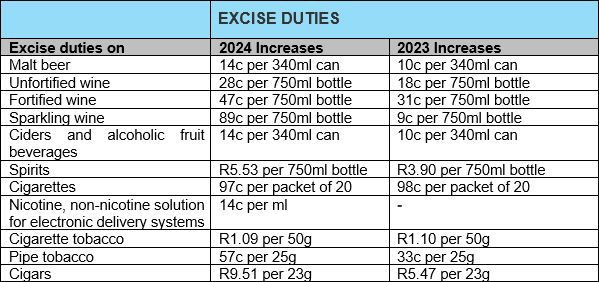

Sin taxes increased

Source: Budget 2024 People’s Guide

Source: Budget 2024 People’s Guide

How much will you be paying in income, petrol and sin taxes?

Use Fin 24’s four-step Budget Calculator here to find out the monthly and annual impact on your income tax, as well as what you will pay in future in terms of fuel and sin taxes, bearing in mind that the best way to fully understand the impact of the announcements in Budget 2024 on your own and your business affairs is to reach out to us for professional advice.

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© CA(SA)DotNews

Recent Comments